Capital, Volume I

From Wikipedia, the free encyclopedia

Capital, Volume I is the first of three volumes in Karl Marx's monumental work, Das Kapital, and the only volume to be published during his lifetime. Originally published in 1867, Marx's aim in Capital, Volume I is to uncover and explain the laws specific to the capitalist mode of production and of the class struggles rooted in these capitalist social relations of production.

[edit] Part One: Commodities and Money

Chapters 1-3 begin with a dense theoretical discussion of the commodity, value, exchange, and the genesis of money. As Marx writes, "Beginnings are always difficult in all sciences ... the section that contains the analysis of commodities, will therefore present the greatest difficulty."[1]

[edit] Chapter 1: The Commodity

Section 1. The Two Factors Of The Commodity: Use-Value And Value (Substance Of Value, Magnitude Of Value)

Marx begins his analysis with what he calls the “commodity.” Marx explains that the commodity is something independent of ourselves that meets a human want or need of any kind. It is clear that Marx is not concerned with why people buy commodities, only that people buying commodities is inevitable. Marx explains that the commodity has something called a “use-value.” The use-value is determined by how useful the commodity is. The actual use-value however is intangible. He explains that use-value can only be determined “in use or consumption.” After determining the use-value of the commodity, something called an “exchange-value” is then derived from it once the commodity is exchanged. He explains this as the quantity of other commodities that it will exchange for. He gives the example of corn and iron. No matter their relationship, there will always be an equation where a certain amount of corn will exchange for a certain amount of iron. He sets up this example to say that all commodities are in essence parallel in that they can always be exchanged for certain quantities of other commodities. He also explains that one cannot determine the exchange value of the commodity simply by looking at it or examining it. The exchange-value is not material. In order to determine the exchange-value, one must see the commodity being exchanged with other commodities. Marx explains that these two aspects of commodities are at the same time separate but also connected in that one cannot be discussed without the other. Marx explains that while the use-value of something can only change in quality, the exchange-value can only change in quantity.

Marx then goes on to explain that the exchange-value of a commodity is merely a portrayal of its value. Value is what makes all commodities connected in that they can all be exchanged with each other. The value of a commodity is determined by its Socially necessary labor time. Socially necessary labor time is defined by “the labor time required to produce any use-value under the conditions of production normal for a given society and with the average degree of skill and intensity of labor prevalent in that society.” Therefore, Marx explains that the value of a commodity does not stay constant as advances or variations in labor productivity occur for any number of reasons. However, value does not mean anything unless it conjoins back to use value. If a commodity is produced that no one wants or has use for, “the labor does not count as labor”, and therefore it has no value. He also says that one can produce use-value without being a commodity. If one produces a commodity solely for his own benefit or need, he has produced use-value but no commodity. Value can only be derived when it the commodity has use-value for others. Marx calls this social use-value. He says all of this to explain that all aspects of the commodity (use-value, exchange-value, and value) are all separate from each other, but are also essentially all connected to each other.

[edit] Section 2. The Dual Character Of The Labour Embodied In Commodities

Marx discusses the relationship between labor and value. Marx states if there is a change in the quantity of labor expended to produce an article, the value of the article will change. This is, in fact, a direct correlation. Marx gives an example of the value of linen versus cloth to explain the worth of each commodity in a capitalist society. Linen is hypothetically twice as valuable as thread because more socially necessary labor time was used to create it. Use-value of every commodity is produced by useful labor. Use-value measures the actual usefulness of a commodity, whereas value is a measurement of exchange value. The source of value is labor-power. Objectively speaking, linen and thread have some value. Different forms of labor create different kinds of use-values. The value of the different use-values created by different types of labor can be compared because both are expenditures of human labor. One coat and ten yards of linen take the same amount of socially necessary labor time to make, so they have the same value.

[edit] Section 3. The Value-Form or Exchange-Value

[edit] (a) The Simple, Isolated, or Accidental Form of Value

In this chapter Marx explains that commodities come in double form. Commodities come in natural form and value form. We don't know commodities' value until we know how much human labor was put in it. Commodities are traded between each other, after their value is decided socially. Then there is value-relation, which lets us trade between different kind of commodities. Marx explains value without using money. Marx uses 20 yards of linen and a coat to show the value of each other. (20 yards of linen = 1 coat, or: 20 yards of linen are worth 1 coat) pg. 139. Marx calls this an equivalent form. He adds that the value 20 yards of linen is just 20 yards of linen, there is no expression of value. Linen is an object of utility and that we cannot tell its value until we compare it to another commodity. Figuring out the value of commodity depends on its position in the expression value. Also commodities value depends in its being expressed or a commodity which the value is being expressed.

[edit] (b) The Total or Expanded Form of Value

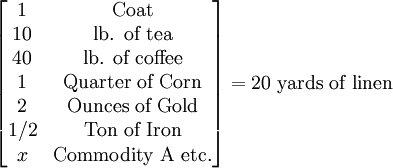

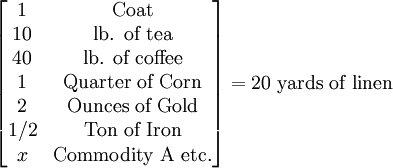

Marx begins this section with an equation for the expanded form of value: "z commodity A = u commodity B or = v commodity C or = w commodity D or = x commodity E or = etc." where the lower case letters (z, u,v, w, and x) represent quantities of a commodity and upper case letters (A, B,C,D, and E) represent specific commodities so that an example of this could be: "20 yards of linen = 1 coat or = 10 lb. tea or = 40 lb. coffee or = 1 quarter of corn or = 2 ounces of gold or = ½ ton of iron or = etc."[2] Marx explains that with this example of the expanded form of value the linen “is now expressed in terms of innumerable other members of the world of commodities. Every other commodity now becomes a mirror of linen’s value.”[2] At this point, the particular use-value of linen becomes unimportant, but rather it is the magnitude of value (determined by socially necessary labor time) possessed in a quantity of linen which determines its exchange with other commodities. This chain of particular kinds (different commodites) of values is endless in that it contains every commodity and is constantly changing as new commodities come into being.

[edit] (c) The General Form of Value

Marx Begins this section with the table:

[3]

[3]

Then he divides this sub-set of section 3 three parts.

(1) The changed character of the form of value.

After highlighting the previous two sub-sets Marx goes on to describe how now that there is a unified exchange-value for said commodities the only thing that differentiates them now is their individual use-value. “The general form of value, on the other hand, can only arise as the joint contribution of the whole of commodities.” (159) Making these values socially influenced and requiring qualitative equivalency as use-values.

(2) The development of the relative and equivalent forms of value: their independence.

Here Marx talks about the inter-relatedness of the relative form and the equivalent form. He first explains that there is a correlation between them even though they are polar opposites. He states that we must also realize that the equivalent form is a representation and an off shoot of the relative form.

“This equivalent has no relative form of value in common with other commodities; its value is rather, expressed relatively in the infinite series of all other physical commodities.” (161)

Things cannot be either completely relative or equivalent. There must be a combination to express the magnitude and universal equivalency. That form is the expanded relative form of value, which is a

“specific relative form of value of the equivalent commodity” (161)

(3) The transition from the general form of value to the money form.

This is the transitory idea between taking the General Form (the universal equivalent form for all general commodities) and turning it into the Money Form. Here Marx describes how there can be a commodity that is so universal to all commodities that it actually that it excludes itself to the point of no longer being an equivalent commodity but a representation of a commodity. The idea of its socially accepted commodity exchange value is so universal that it can be then transition into a form of money. IE Gold.

[edit] (d) The Money Form

[4]

[4]

Here Marx illustrated the shift to “Money Form." Universal equivalent form or universal exchangeability has caused gold to take the place of linen in the socially accepted customs of exchange. Once it had reached a set value in the world of commodities gold became the money commodity. Which is distinct from Section A, B, or C.

Now that gold has a relative value against a commodity such as linen is can now attain price form.

“The ‘price form’ of linen is therefore: 20 yards of linen = 2 ounces of gold, or, if 2 ounces of gold when coined are £2, 20 yards of linen = £2.” (163)

This illustrates the application of price form as a universal equivalent. The simplified application of this idea is then illustrated as:

x of commodity A = y of commodity B

[edit] Section 4. The Fetishism of the Commodity and Its Secret

Marx's inquiry in this section focuses on the nature of the commodity, apart from its basic use-value. In other words, why does the commodity in its value-form (exchange) appear to be something other than the aggregation of homogenous human labor? Marx contends that due to the historical circumstances of capitalist society, the values of commodities are usually studied by political economists in their most advanced form: money. These economists see the value of the commodity as something metaphysically autonomous from the social labor that is the actual determinant of value. Marx calls this fetishism - the process whereby the society that originally generated an idea eventually, through the distance of time, forgets that the idea is actually a social and therefore all-too-human product. What this means is that this society will not look beneath the veneer of the idea (in this case the value of commodities) as it currently exists. They will simply take the idea as a natural and/or God-given inevitability that they are powerless to alter. Marx compares this fetishism to the manufacturing of religious belief; people initially create a deity to fulfill whatever desire or need they have in present circumstances, but then these products of the human brain appear as autonomous figures endowed with a life of their own, which enter into a relation both with each other and with the human race (165). Similarly, commodities only enter into relation with each other through exchange, which is a purely social phenomenon. Before that, they are simply useful items, but not commodities. Value itself cannot come from use-value because there is no way to compare or contrast the usefulness of an item; there are simply too many potential functions. So once in exchange, their value is determined by the amount of socially useful labor-time put into them because labor can be generalized. It takes longer to mine diamonds than it does to dig for quartz, thus diamonds are worth more. Fetishism within capitalism occurs once labor has been socially divided and centrally coordinated, and the worker no longer owns the means of production. They no longer have access to the knowledge of how much labor went into a product because they no longer control its distribution. From there, the only obvious determinant of value to the mass of people is the value that has been assigned in the past. Thus the value of a commodity seems to arise from a mystical property inherent to it, rather than from the labor-time, the actual determinant of value.

[edit] Chapter 2: The Process of Exchange

In Chapter 2 Marx explains commodity exchange and the fact that commodities need assistance to be exchanged. Marx states that "humans are made for each other to be holders or representatives of commodities."[5] The commodities need to be exchanged so we must look to the owners of the object and view them as owners of private property. In order for an object to enter as a commodity the guardian must place the object in relation to all other objects. For the owner, the object has no direct use-value but having a use-value for everyone else. The only use-value for the owner is within its own exchange-value. So the owner will decide to sell his item in return for objects with use-values for himself. If the items change hands this is an exchange, and it gives each of the items a value related to each other. So far exchange is an individual process and the owner looks at every other commodity as an equivalent to his own, making his commodity the universal equivalent. Since all owners look at the situation like this there is no actual universal equivalent and the objects are not yet commodities but still only use-values. So a universal equivalent must be realized. Only society can make this happen through setting aside a particular commodity to be the universal equivalent, making this item money. “Money necessarily crystallizes out of the process of exchange, in which different products of labour are in fact equated with each other, and thus converted into commodities.”[6] As the process of exchange furthers on objects begin to get produced solely for exchange and a distinction between a use-value and an exchange-value is created. Before an individual commodity was set aside as money, any exchange of commodity showed a simple form of value showing, x commodity A= y commodity B. Once a commodity is set aside it takes on the money form of value, putting all commodities against it. A form of money usually comes from two places, from the most important article exchanged within a community or an object showing wealth within a society, like cattle in some cultures. Gold and silver were acquired as a natural form of money because their natural properties showed good qualities of a form of money. Though also commodities, gold and silver have a uniform quality and can divided into different increments allowing the metals to naturally be used as money. Making these commodities into money gives the metal its value-form and not its value. Even though a commodity is set aside as money we must still figure what a certain amount of the commodity is worth. This is done by looking at the labor time it took to produce and equating it to the labor time of another commodity. The exchange of commodities went from individual trades of commodities to a complex system of money and value. Closing the chapter, Marx states that "Men are henceforth related to each other in their social process of production in a purely atomistic way. ... because the products of men's labour universally take on the form of commodities."[7]

[edit] Chapter 3: Money, or the Circulation of Commodities

[edit] 1. The Measure of Values

Functions of Metallic Money

In chapter 3 section I Marx examines the functions of money commodities. According to Marx the main function of money is to provide commodities with the medium for the expression of their values, i.e. labor time. The function of money as a measure of value serves only in an imaginary or ideal capacity. That is, the money that performs the functions of a measure of value is only imaginary because it is society that has given the money its value. The value that is contained in one ton of iron for example, is expressed by an imaginary quantity of the money commodity, which contains the same amount of labor as the gold.

- Multiple Forms of Metallic Money

As a measure of value and a standard of price money performs two functions. First it is the measure of value as the social incarnation of human labor and secondly it serves as a standard of price as a quantity of metal with a fixed weight. As in any case where quantities of the same denomination are to be measured the stability of the measurement is of the utmost importance. Hence the less the unit of measurement is subject to variations the better it fulfills its role. Metallic currency may only serve as a measure of value because it is itself a product of human labor.

Commodities with definite prices appear in this form: a commodity A= x gold; b commodity B= y gold; c commodity C= z gold, etc where a, b,c represent definite quantities of the commodities A, B,C and x, y,z definite quantities of gold. In spite of the varieties of commodities their values become magnitudes of the same denomination, gold-magnitudes. Since these commodities are all magnitudes of gold they are comparable and interchangeable.

- Price

Price is the money-name of the labor objectified in a commodity. Like the relative form of value in general, price expresses the value of a commodity by asserting that a given quantity of the equivalent is directly interchangeable. The price form implies both the exchangeability of commodities for money and the necessity of exchange. Gold serves as an ideal measure of value only because it has already established itself as the money commodity in the process of exchange.

[edit] 2. The Means of Circulation

[edit] (a) The Metamorphosis of Commodities

In this section Marx further examines the paradoxical nature of the exchange of commodities. The contradictions that exist within the process of exchange provide the structure for “social metabolism”. The process of social metabolism “transfers commodities from hands in which they are non-use-values to hands in which they are use-values…” (198). Commodities can only exist as “values” for a seller and “use-values” for a buyer. In order for a commodity to be both a “value” and a “use-value” it must be produced for exchange. The process of exchange alienates the ordinary commodity when its antithesis, the “money commodity” becomes involved. During exchange, the money commodity confronts the ordinary commodity disguising the true form of the ordinary commodity. Commodities and money are at opposites spectrums, and exist as separate entities. In the process of exchange, gold or money, functions as “exchange-value” while commodities function as “use-values”. A commodity’s existence is only validated through the form of money and money is only validated through the form of a commodity. This dualistic phenomenon involving money and commodities is directly related to Marx’s concept of “use-value” and “value”.

Commodity-Money-Commodity

C − > M − > C

Marx examines the two metamorphoses of the commodity through sale and purchase. In this process, “as far as concerns its material content, the movement is C-C, the exchange of one commodity for another, the metabolic interaction of social labor, in whose result the process itself becomes extinguished” (200).

C − > M

First metamorphosis of the commodity, or sale. In the process of sale, the value of a commodity, which is measured by socially necessary labor-time, is then measured by the universal equivalent, gold.

M − > C

The second or concluding metamorphosis of the commodity: purchase. Through the process of purchase all commodities lose their form by the universal alienator, money. “Since every commodity disappears when it becomes money it is impossible to tell from the money itself how it got into the hands of its possessor, or what article has been changed into it” (205).

M − > C = C − > M

A purchase represents a sale although they are two separate transformations. This process allows for the movement of commodities and the circulation of money.

[edit] (b) The Circulation of Money

The circulation of money is first initiated by the transformation of a commodity into money. The commodity is taken from its natural state and transformed into its monetary state. When this happens the commodity “falls out of circulation into consumption”. The previous commodity now in its monetary form replaces a new and different commodity continuing the circulation of money. In this process, money is the means for the movement and circulation of commodities. Money assumes the measure of value of a commodity (i.e.) the socially necessary labor-time. The repetition of this process constantly removes commodities from their starting places, taking them out of the sphere of circulation. Money circulates in the sphere and fluctuates with the sum of all the commodities that co-exist within the sphere. The price of commodities varies by three factors. “…the movement of prices, the quantity of commodities in circulation, and the velocity of circulation of money” (218).

[edit] (c) Coin. The Symbol of Value

Money takes the shape of a coin because of how it behaves in the sphere of circulation. Gold became the universal equivalent by the measurement of its weight in relation to commodities. This process was a job that belonged to the state. The problem with gold is that it wore down as it circulated from hand to hand. The introduction of paper money as a representation of gold arose from the state as a new circulating medium. This form of imaginary expression continues to mystify and intrigue. Marx views money as a “symbolic existence” which haunts the sphere of circulation and arbitrarily measures the product of labor.

[edit] 3. Money

[edit] (a) Hoarding

The exchange of money is a continuous flow of sales and purchase. Marx goes on to say, “In order to be able to buy without selling, he must have previously sold without buying.” This simple illustration demonstrates the essence of hoarding. In order to potentially buy, without selling a commodity in your possession, you must have hoarded some degree of money in the past. Money becomes greatly desired due to potential purchasing power. If you have money, you can exchange this for commodities and vice versa. However, while satisfying this newly arisen fetish for gold, the hoard causes the hoarder to make personal sacrifices.

[edit] (b) Means of Payment

In this section Marx analyzes the relationship between debtor and creditor and exemplifies the idea of the transfer of debt. In relation to this, Marx discusses how the money-form has become a means of incremental payment for a service or purchase. He states that the “function of money as means of payment begins to spread out beyond the sphere of circulation of commodities. It becomes the universal material of contracts.” Due to fixed payments and the like, debtors are forced to hoard money in preparation for these dates. “While hoarding, as a distinct mode of acquiring riches, vanishes with the progress of civil society, the formation of reserves of the means of payment grows with that progress.”

[edit] (c) World Money

Countries have reserves of gold and silver for two purposes: (1) Home Circulation; and (2) External Circulation in World Markets. Marx says that it is essential for countries to hoard, as it is needed “as the medium of the home circulation and home payments, and in part out of its function of money of the world.” With all of this discussed hoarding and the aforementioned idea of hoarded money’s inability to contribute to the growth of a capitalist society, Marx states that banks are the relief to this problem. “Countries in which the bourgeois form of production is developed to a certain extent, limit the hoards concentrated in the strong rooms of the banks to the minimum required for the proper performance of their peculiar functions. Whenever these hoards are strikingly above their average level, it is, with some exceptions, an indication of stagnation in the circulation of commodities, of an interruption in the even flow of their metamorphoses.”

[edit] Part Two: The Transformation of Money into Capital

Chapters 4-6 connect the abstract discussion of commodities, money, and value begun in Part I with their role in the formation of class relations under capitalism.

[edit] Chapter 4: The General Formula For Capital

In this chapter, Marx explains what capital is and how it is produced. The form of capital is money, yet not all money is capital. In Marx’s words there is “money as money" and "money as capital" (247). For money to be converted into the form of capital, it must undergo a deliberate process based on the circulation of commodities in an exchange market.

There are two different forms of commodity circulation: the direct or simple form of circulation (C-M-C) and the capital-generating form (M-C-M). Two common elements can easily be identified: the sale of a commodity (C-M) and the purchase of a commodity (M-C). Clearly the two contrast simply by their order in which the sale and purchase occur.

In the first form (C-M-C), a commodity is produced in order that one may acquire the means to purchase another commodity i.e. “selling in order to buy” (247). This particular form of commodity circulation is essentially a closed system. Once a commodity has been obtained by the purchase (M-C), the commodity exits the exchange-market thereby achieving its aim as a use-value, consumed according to necessity. The money is simply expended achieving its objective as a medium of exchange between two qualitatively different commodities.

The second, capital-generating form of commodity production (M-C-M) is simply an inversion of the previous form. In this instance, money purchases a commodity (M-C) in order that it be sold for money i.e. "buying in order to sell" (248). In contrast to the simple form of circulation, the capital-generating form culminates in the reflux, or return of money back to the capitalist as the desired result. Essentially money is exchanged for money (M-M). Since money is the starting point and conclusion of the capital-generating form of circulation "its determining purpose, is therefore exchange-value" (250). Consequently, use-values of commodities become negligible while the exchange-value of a commodity acquires meaning solely in the context of exchange. Therefore, in order for money to retain its form as capital it must remain in circulation otherwise it would simply be expended.

Finally, we must consider the role and motivations of the capitalist in the capital-generating form of circulation. If one expends money for the sake of receiving its return, then the capitalist necessarily desires its augmentation known as surplus-value. Since capital must remain in circulation, it manifests itself as ongoing process without end. The new value (original + surplus) becomes the starting point of a new cycle for the capitalist to exchange his money for more money. Therefore, the general formula for capital becomes M-C-M' in which M'=M+ΔM or the original value of money plus some increment of money, or surplus-value.

[edit] Chapter 5: Contradictions in the General Formula

After distinguishing money as capital (M-C-M) from money in general, Marx raises the question of how the capitalist accrues surplus-value by buying a commodity and then selling it. The key problem is how the exchange of equivalent values can produce more value. He rejects 5 possibilities:

- First: Marx recognizes that use-value changes among buyers. So, one could just sell the commodity to the buyer with the most use-value and charge more to them. However, use-value does not determine value which is what is being created as a surplus. Since money is the universal equivalent of value, “the circulation of commodities involves a change only in the form of their values”.[8] As above, one can exchange 2oz of gold for only 1 coat and get only 2oz of gold for that coat, so long as the socially necessary labor time remains constant. Use-value plays no role in these formulas.

- Second: In principle, “commodities may be sold at prices which diverge from their values, but this divergence appears as an infringement of the laws governing the exchange of commodities”.[9] Yet, the capitalist may possess some privilege by which s/he can sell above value. However, other capitalists have this privilege and overcharge the first capitalist who then loses his/her profit. The result is nominal price inflation which only changes the purchasing power of money, but not the real value.[10]

- Third: There could be a class of people who consume but do not produce. They pay for commodities, and thus have money, without having produced and sold some commodity beforehand. The “free” money they thus put into circulation can be used to artificially alter exchange-values. However, since the consumption class has money without producing anything, the money must come from those outside of the consumption class. (Marx gives the example of Roman taxes.) Thus this class uses others' money to buy those people's products. No actual surplus-value is being created.[11]

- Fourth: It may be that the capitalist overcharges a buyer as in the second rejection, but the buyer cannot recover the lost value and the capitalist will not be overcharged him/herself. However, there is still no surplus-value. If the buyer has $40 and the capitalist a $10 shirt, there is a total value of $50 in circulation. If the buyer pays $20 for the $10 shirt and has $20 left over, there is still a total value of $50. The only change is distribution of wealth.[12]

- Fifth: Since the circulation of commodities is between equivalent values, any surplus-value must emerge outside of this circulation. However, outside of circulation, the value of a commodity is only the labor put into it. The producer “cannot create values which can valorize themselves.” Surplus-value thus cannot emerge outside of circulation.[13]

Conclusion: “Circulation, or the exchange of commodities, creates no value”.[14] Only labor does. And, since nothing external to circulation creates value, something must be operating within circulation which is not circulation itself. Marx closes with the contradiction: "The transformation of money into capital has to be developed on the basis of the immanent laws of the exchange of commodities, in such a way that the starting-point is the exchange of equivalents".[15]

[edit] Chapter 6: The Sale and Purchase of Labour-Power

Marx Starts off this chapter by stating that the change in the value of money into capital can’t happen in the second act of circulation, but takes place in the first act, M-C. This change can only originate from the use-value of the commodity, which comes from its consumption. The money-owner must find a commodity with a use-value that is also a source-value. This such commodity is labour power.

Labour power is the mental and physical capabilities of a human being, which are set in motion whenever a person produces a use-value. Labour power can only be found on the market when a free worker is available. This worker must be free in two ways. First he must be free as a worker; he must be willingly disposing of his labour power as his own commodity. But the worker must make sure that he sells his labour power for only a limited period of time otherwise he will become a commodity himself, a slave. Second he must have no other commodity for sale; he is free of them all. In order for one to sell commodities other than his own he must have means of production, or raw materials, and a free worker does not usually have these, he usually only has his own labour to sell.

The division between men who are owners of money or commodities and men who only have their labour to sell is not a natural process. It is clearly the production of a past historical development, the product of many economic revolutions. It is a process of the capitalist mode of production. The historical condition of capital’s existence is not just because of the circulation of money and commodities. It is present because a free worker puts himself out there, willingly, for an owner of means of subsistence and production to scoop up and take advantage of.

How is labour power’s value determined? The value of labour power is determined by the labour power necessary for the production and reproduction of it. Labour power exists as the capacity of the living individual, what it takes for the individual to maintain himself. For his maintenance he requires some form of means of subsistence. Means of subsistence is what keeps the worker going, he must consume before and while he produces. The value of labour power is the value of the means of subsistence the owner of the labour power requires. An individual’s natural needs vary with the social conditions he is used to in his country.

The sum of a worker’s means of subsistence is complicated. It must also include the means necessary for the worker’s replacements. This is necessary to capital because capital requires an undiminished supply of labour. Education and training for the worker must be included in the cost as well. Some means of subsistence are used every day, such as food and water, and must be replaced every day. While others, such as clothing, need to be replaced after longer intervals. These commodities must all be available to the worker through his average income in order for him to be able to produce labour power.

A consequence of labour power as a commodity is that it doesn’t immediately pass into the hands of the buyer. Its value is already determined before it enters circulation, but its use-value is only determined later. The money of the buyer serves as means of payment. In every country with the capitalist form of production the money-owner doesn’t pay for labour power until it is exercised for a set period of time. So the worker is advancing the use-value of his labour to the money-owner.

At the end of this chapter Marx states that we must leave the sphere of circulation or commodity exchange in order to see how capital produces and how it itself is produced. When we leave this sphere a certain change takes place. “He who was previously the money-owner now strides out in front as a capitalist; the possessor of labour power follows as his worker.”

[edit] Part Three: The Production of Absolute-Surplus Value

In chapters 7-11, Marx elaborates his analysis of exploitation and the extraction of surplus-value. He highlights both the fundamental way in which capital seeks to increase the rate of surplus-value through lengthening the working day, as well as the variety of ways workers strive to resist this increased exploitation.

[edit] Chapter 7: The Labour Process and the Valorization Process

[edit] 1. The Labor Process

The utilization of a worker’s labor-power is the labor process. The process changes the objects being worked upon—which was the intention of the worker at the start of the process—and creates use-values which can be called products or commodities. Labor will ultimately be objectified in the final product produced by this process. Marx points out that this production of use-values (the labor process) is the same under capitalism or any other economic system, and that the simple elements of this process are: 1. Purposeful activity—the work itself

2. An object on which work is carried out (object of labor)

a. Marx calls the object of labor a raw material when it has undergone some alteration by means of a previous labor process.

3. Instruments of labor

a. A thing or complex of things which the worker uses in acting on the object of labor

b. Marx considers all objective conditions necessary for carrying out the labor process to be instruments of labor.

The means of production are made up of the instruments and object(s) of labor. These instruments and objects are often the use-values of previous labor. A hammer (instrument) used to nail up sheetrock (object) and the sheetrock itself are both use-values (products of earlier labor) incorporated into the labor process of building a wall as well as means of producing a wall. If a use-value involved in the labor process is an object of labor, instrument of labor or product of labor depends on that use-values’ role in the process. The fact that use-values produced by prior labor can become means of production for other labor illustrates that labor itself is in part a process of consumption. Marx calls this consumption productive consumption. The persons consuming in the course of action of productive consumption are the workers whose labor-power is the force that gives the labor process its life.

Capitalism and the labor process:

To the capitalist labor-power is a necessary use-value or product purchased to animate the labor process. Without labor-power, the capitalist cannot be successful—his/her objects and instruments of labor would be wasted raw materials with no one to create the use-value or commodity the capitalist wishes to sale on the market. Marx points out that labor-power is a commodity which the capitalist consumes by causing the worker (who is selling the labor-power) to consume the means of production by his/her labor. Marx points out two phenomena of the capitalist’s consumption of labor-power: 1. The worker works under the control of the capitalist to whom his labor belongs.

2. The product is the property of the capitalist and not that of the worker—the person who made the product.

[edit] 2. The Valorization Process

The capitalist strives to produce a use-value with exchange-value (a commodity) that has a greater value than the sum of its parts (the means of production and labor-power). The process of production must therefore be understood as the synthesis of the labor process and the process of creating value.

Marx uses as an example of valorization the spinning of cotton into yarn. When the capitalist purchases 10 lb. of cotton at its full value of 10 shillings, the price conveys the labor objectified in the cotton. In addition, all of the socially necessary means of production used up in the cotton’s production, which Marx represents in the wear and tear of the spindle, have a value of 2 shillings.

To determine the value of the yarn, then, all of the successive processes necessary to produce the cotton, manufacture the spindle, and spin the yarn must be taken into account. The values of the means of production, the 12 shillings, are a part of the total value of the product.

There are two conditions that must be met for this process to produce value. First, a use-value must have been produced. Second, the labor-time used to produce the use-value (in this case yarn) must be no more than that which is socially-necessary.

Yet these factors still only amount to a portion of the total value of the yarn; labor constitutes the remainder. Since labor-power is “absorbed” by the raw material in the form of spinning, the resulting yarn “is now nothing more than a measure of the labor absorbed by the cotton.”[16]

Value is added to the yarn by the labor objectified in it. The value of a day’s labor-power (six hours of labor) is 3 shillings. Assuming the spinner can turn 10 lb. of cotton into 10 lb. of yarn in six hours, the cotton contains six hours of labor, the same amount contained by 3 shillings of gold. Spinning, then, has added a value of 3 shillings to the cotton.

The total value of the 10 lb. of yarn is calculated by adding all of the socially necessary means of production used up and all of the socially necessary labor absorbed. Two days of labor were absorbed by the cotton and spindle, a half a day by the process of spinning. The two and a half days of labor are represented by a piece of gold valued at 15 shillings. This is thus the price of the 10 lb. of yarn.

In this process, though, the capitalist has not created surplus-value, even though value has been added to the product (10 shillings to produce the cotton, 2 shillings for the worn spindle, and 3 shillings to purchase the labor-power). The capitalist has broken even, which is not why they entered business.

The capitalist realizes that the worker spins for only six hours to survive for twenty-four hours, and could remain effective for twelve hours. This increases the value created twofold. The two and a half days of labor become five, the 10 lb. of yarn becomes 20, and the value created becomes 30 shillings. The price of the 20 lb. of cotton is thus 30 shillings, but the total value of the labor and means of production is only 27 shillings. A surplus-value of three shillings has been created, and money has been transformed into capital.

Everything is exchanged equally and the capitalist pays the full value for each commodity consumed.

[edit] Chapter 8: Constant Capital and Variable Capital

In Chapter 8, Marx describes how labor simultaneously transfers the previous use-value of the all the means of production and creates surplus value within a product. The differences in these types of values create the division between Constant Capital and Variable Capital. Marx defines Constant Capital as, “That part of capital, therefore, which is turned into means of production, i.e. the raw material, the auxiliary material and the instruments of labor, does not undergo any quantitative alteration of value in the process of production. [17]Constant Capital remains a constant quantifiable entity because the means of production that transfer use-value to raw materials, “never transfer more value to the product than they themselves lose during the labor process by the destruction of their own use value." [18]Even with a change in price, in Marx’s example, the raw material of cotton, the new price of that cotton will transferred to the product, but no new value has been created.

Marx contrasts Constant Capital with Variable Capital saying, “That part of capital which is turned into labor-power does undergo an alteration of value in the process of production. It both reproduces the equivalent of its own value and produces an excess, a surplus value, which may itself vary, and be more or less according to circumstances” [19]. With Variable Capital, the laborer not only transfers the value of all previous inputs, but also adds surplus value to the product. Marx provides the example; while it may only take 6 hours of socially necessary labor time to incorporate into the product the equivalent for the value of labor power, the process lasts longer, say 12 hours. The activity of labor power then not only reproduces its own value, but also produces a surplus value which is the difference between the value of the product and the elements consumed in the formation of the product, i.e. the means of production and the labor power. Even if improved technology in the labor process allows one worker to do one hundred times the work of ten men, this only serves to increase the Constant Capital while decreasing Variable Capital in the labor process and does not affect the essential difference between the two [20].

[edit] Chapter 9: The Rate of Surplus Value

1. The Degree of Exploitation of Labor-Power Capital advanced is the sum of constant capital and variable capital.

C = c + v

For example $500 (advanced capital) = $410 (constant) + $90 (labor)

Through the process of production a surplus, s, is created. The resulting sum is C’ constituting the total of constant capital, variable capital, and surplus value. Thus

C’ = (c + v) + s

For example $590 = $410 + $90 + $90 (surplus)

Surplus value comprises the excess of the value of the commodity produced over the capital advanced for production. Constant capital transfers only part of its value during the process of production, as the remainder of its value continues to reside in the machinery. This does not alter the calculation because the constant value incorporated in the equation is only concerned with the materials actually utilized in production. For example, if the constant capital equals $410, it could be broken down as such

$ 312 raw materials

$ 44 auxiliary materials

$ 54 value of the machine worn away during production

c = $ 410

Let’s say the total value of the machinery itself costs $1054. The only value imparted to the product is the $54 of wear, because the machinery retains $1000 of value. If this value is entered into the equation, it must be entered on both sides.

C = $500, + $1000 = $1500 C’ = $590, + $1000 = $1590

Either considering or neglecting the value retained by the machinery results in the same difference, or surplus value, of $90. Constant capital, c, will therefore refer solely to the value actually consumed during production. The constant capital advanced transfers all of its value to the product and therefore cannot produce surplus value. Thus we can equate constant capital with 0. The new value produced is therefore not the total value of the product, (c + v) + s or $590, but the sum of variable capital and surplus value, v + s or $180. The absolute quantity of surplus value is $90. The relative quantity of surplus value, or rate of exploitation, can be determined by s/v. In our example this equates to 90/90, or % 100.

2. The Representation of the Components of the Value of the Product by Corresponding Proportional Parts of the Product Itself

In order to explain the conversion of money into capital, Marx offers an example of yarn production. A 12-hour workday produces 20 lbs of yarn valued at a total of 30s. 24s of value are the result of constant capital (20 lbs of cotton at 20s, and 4s for repair of the machine). The remaining 6s includes the variable capital (the worker’s wage) and the surplus value (profit). The workers wage is 3s and 3s of surplus are produced, equaling a % 100 rate of exploitation (3s/3s). This exploitation occurs not only during the process of spinning the yarn, but during the production of all its constituents (i.e. picking the cotton, building the spindle etc.)

3. Senior’s “Last Hour”

In section 3 of chapter 9, Marx condemns the economic analysis of cotton mills conducted by Professor Nassau W. Senior in his pamphlet “Letters on the Factory Act, as it affects the cotton manufacture.” The pamphlet suggest that the entirety of the surplus value is produced during the last hour of a 12 hour workday, with the remainder contributing to the wage of the worker. Marx disputes Senior’s analysis on the grounds that Senior failed to separate constant and variable capital, instead including the mill and machinery as one factor and the wages and raw material as a second factor. This failure to discern between variable and constant capital was considered by Marx to be a crucial blunder. Marx also notes that the value produced during each hour is likely to be equal, and if 11 hours were contributing to wages, with 1 hour producing net profit, that proportion should be reflected in the ratio of wages paid to profits.

Senior’s calculations do not take into account the value embedded in the constant capital and takes for granted their contribution of value to the finished product, instead of acknowledging that the method of transferring that value is through the use of labor-power.

4. Surplus Produce

Surplus-produce refers to the portion of the product that represents surplus-value. Like the ratio of surplus value to variable capital, the relative quantity of surplus production is determined by the ratio of surplus-produce to the part of the total product in which necessary labor time is incorporated. The sum of necessary and surplus labor constitutes the working day.

[edit] Chapter 10: The Working Day

"1. The Limits of the Working Day."

Value of labor power is the necessary labor time required for a worker to produce an amount equal to his means of subsistence. Any amount of time worked beyond the necessary labor time is called surplus labor. The Working Day = A-------B----------C. The line AC represents the working day. AB is the necessary labor time and BC is surplus labor. Under the Capitalist system, Marx says that a working day can never be reduced to necessary labor time only. This would not profit the capitalist and profits are the capitalist’s goal. Furthermore, employees are only a personification of capital and capital’s only aim is, “the drive to valorize itself.” Marx proceeds to describe the two factors that limit the maximum length of the working day. First, there are physical limits to labor power. A worker can only work for so long before he must rest, eat, sleep, etc. In addition to physical limitations, there are moral obstacles that limit the working day. “The worker needs time in which to satisfy his intellectual and social requirements, and the extent and the number of these requirements is conditioned by the general level of civilization.” The capitalist seeks to create the most surplus value he can by extending the working day to absorb the greatest possible amount of surplus labor, i.e. extending line segment B --- C as far as possible. In other words, the capitalist is like any other buyer of commodities; he wants to extract the maximum use value of his commodity, which in this case is labor power. The consumption of labor power creates more value than it costs, and labor power is a very unique commodity in that it is the only valorizing commodity. All other commodities are congealed quantities of labor power lying dormant when not in the process of production. Marx says, “Capital is dead labor which, vampire-like, lives only by sucking living labor, and lives the more, the more labor it sucks.” This is the logic at the heart of the capitalist’s desire to increase the length of the working day. Now, the worker who sells this commodity, labor power, hopes to be able to reproduce that same commodity and have it ready to resell again the next day. If the working day is extended too far, the capitalist may extract a greater quantity of labor power than the worker is able to restore before his next shift begins. This will cause significant deterioration in the health of the worker. Marx goes on to describe how the process of overwork leads to the worker being unfairly compensated for the exchange value of his labor power reflected in his daily wages. He provides the following example: If the average length of time a worker can live and do a reasonable amount of work is 30 years, the value of his labor power for which he is paid from day to day is: 1 /( 365 x 30) or 1 / 10,950 of its total value. If worked too hard and the value of his labor power is consumed in 10 years, he is still paid the same amount. That is 1 / 10,950 of his labor power daily instead of 1 / 3650; therefore, he is only paid 1 / 3 the value of his labor power daily, and is robbed of 2 / 3. A normal length working day is being demanded by the worker as the seller of his commodity in a market governed by the law of commodity exchange. If the capitalist consumes a quantity of labor power that takes three days time to replenish, but has only paid for one day’s worth of labor power, then the worker as the seller of his commodity is being cheated. Hence the worker simply seeks equal value for the sale of his commodity, and the capitalist seeks, equally justified, the right to consume the labor power he has purchased as efficiently as possible. The two parties are both merited and yet at ends with one another, therefore, a struggle between collective capital (class of capitalists) and collective labor (working classes) over the length of the working day ensues.

"2. The Voracious Appetite for Surplus Labor. Manufacturer and Boyar."

“Capital did not invent surplus labor”, begins Marx. But in capital, necessary labor time and surplus labor time are meshed together, indistinguishable to the worker, creating an opaque understanding of who the worker is working for when. Historically, the time spent by the worker working for himself compared to the time the worker spent working for his feudal lord, or other type figure head, was easily distinguishable because there were separate fields that the worker would work, one for his own food production, and then another field belonging to the feudal lord would receive so many allotted days of labor. In capital factory systems, the proportion of work spent toward the workers own reproduction of his means of subsistence, the necessary labor time, and that designated to producing surplus value for the capitalist is unknown to the worker, enabling the capitalist to exploit that relation leaving the worker still unaware of the magnitudes of this proportion as it is hidden behind the value of the worker’s daily wage. Marx then focuses of the tendency of the owners of the means of production to further exploit and continue the extraction of greater and greater amounts of surplus labor out of workers, often by unscrupulous means. He gives two main examples. The first is the system of the “corvée” in the Danubian provinces of precapitalist Russia. The second example is that of a fraudulent capitalist factory owner. Under the corvée system of the early 19th century, the peasant owed a specific quantity of labor to the landlord annually. This labor consisted of 12 general labor days, one day of field labor, and one day of wood carrying. This amounted to a total of 14 days a year. These days were not average work days, however. They amounted to the total time necessary to produce an average daily product. Russian leaders took such great liberties in deciding what an average daily product was so that it turned out to be equal to three days of actual work to produce. The 14 days of corvée thus became 42 days of required labor time. This same process eventually repeated once 42 days had become the expected but unspoken standard quantity of product; the amount of work to produce this newly expected quantity then amounted to 126 days. Now, after subtracting the Sundays of the year and the days of rainy season, the 14 days of corvée, as one Moldavian boyar put it, “drunk with victory, ‘amount to 365 days in the year.” Marx then gives a few more examples of ways in which the landlords were able to extract more and more surplus value from the exploited working class. He refers to gold miners and cotton pickers (when cotton was in high demand) being worked to literal death because there labor yielded such large quantities of surplus value that the labor power as a commodity was expendable. The second main example for the strong appetite capitalists have for surplus labor is that of a fraudulent factory owner that illegally extends the length of the working day. He does this by starting work 10 or 15 minutes early or by shaving a few minutes off of the beginning and ending of breaks and lunch hours. These robberies of minutes here and there add up to hours of uncompensated surplus labor over the course of a week, and weeks of surplus labor over the course of a year, all from a few moments the capitalist tries to steal. The gains are significant because, “moments are the element of profit.” Even when demand for an industry is low, the capitalist still aims to exploit the worker all the more. They call running less days of production, short time labor, or hiring part time employees, and when such circumstances are in effect, the capitalist tries all the harder to increase surplus labor time to obtain profits while he can off the exploitation of workers that will not be permanent employees. In 1850 the Factory Act had been implemented to limit the hours of the working day to just10 hours, but all of these examples of fraudulent management still occur. The reason being that, “The profit to be gained by it’ (over-working in violation of the Act) ‘appears to be, to many, a greater temptation than they can resist; they calculate upon the chance of not being found out; and when they see the small amount of penalty and costs, which those who have been convicted have had to pay, they find that if they should be detected there will still be a considerable balance of gain…”

"3. Branches of English Industry without Legal Limits to Exploitation"

In this section, Marx presents the historical debate regarding the work day and the exploitation of children. Using examples of match manufacturing, bread-making, lace manufacture, pottery, wall paper making, milliners, train engineers, and blacksmiths, Marx describes the issues children, women and men faced by working extremely long hours in poor conditions at very young ages. In many cases, these children died or faced long-term ailments related to pulmonary infections or general malnutrition and physical degradation because of particulate matter in the production process and extremely rigorous hours. Marx also covers similar issues of exploitation of entire populations as sighted by doctors over time. Working at this rate, skipping meals and through all hours of the night, day after day was destroying the working class. Reservation for meal times and being able to eat away from the dirty conditions of the machinery operating areas is becoming a value that will be necessary to mandate for workers rights as highlighted by all of these injustices Marx found documented. Food must be supplied to the laborer in the same sense that machines need oil, a steam engine needs coal and water: workers, the instruments of labor need food.

"4. Day-Work and Night-Work. The Shift-System"

Means of production (constant capital) exists to be used to produce commodities. When not in use, no valorization of surplus-labor is occurring. In order to produce 24 hours a day, the capitalist realized that by instituting shift-work, he could both maximize his profits while allowing the individual worker to get his necessary rest. Yet, even with the shift system, we see that the capitalist still aims to exploit the worker by obtaining more surplus labor time from the workers. And new evils emerge. Young children are depended on for working the night shift because the strength of the adult men would be deteriorated if they had to work the entire night. (How ironic that men would be exhausted working the night shift, therefore children are better suited for the task?) Other exploitations occur in the way of kids having to work a double if their relief does not show up to work the next shift, and holding the shift longer to realize any benefits of the increased number of laborers that can be obtained over the first hour or two of shift switch. Marx tries to point out all the fallacies in the capitalists’ objections to ending the employment of children over the night shift.

"5. The Struggle for a Normal Working Day. Laws for the Compulsory Extension of the Working Day, from the Middle of the Fourteenth to the End of the Seventeenth Century"

Ideally a capitalist would have an individual worker producing 24 hours a day with only so much rest time as the worker needed to continue to function. The worker is nothing more to the capitalist than labor-power and a means to accumulate surplus-value and so the worker’s personal time means nothing to the capitalist, moreover the length of the individual worker’s life means nothing to capital, except that it has extracted the most surplus value from that individual as possible. Yet according to Marx, having this attitude is a double-edge sword in that if the capitalist had his way and exploited the worker to this extent, he would in essence be killing his own workforce. If this process yields a more favorable proportion of surplus labor to necessary labor time, then the capitalist should reap advantage of its workers, but at the same time keep in mind the need to replace the worker the next day. Hence, capital spent a good number of years absorbing the available workforce. Once all available labor power has been absorbed and is working, then capital has to regard providing the proper means for the workforce to not only regenerate their own commodity, labor-power, for resale each day, but also has to provide enough means of subsistence in wages to allow the worker to procreate bring a new generation of available labor power to the plate. This is the point at which capital realizes that the value of labor-power (the worker) includes all of the commodities that go into keeping the worker alive. In the end, it will be more expensive for the capitalist to replace a worker than to keep one sustained adequately. Ultimately it is in capital’s best interest to not have an individual work 24 hours a day with only necessary breaks but to have a work day that is short enough to sustain healthy strong labor-power. Marx cites several different economists arguing on behalf of both parties (Capitalists and the Proletariat) as he sums up the literature that has affected the different legislations in place at different times limiting the working day, sets aside standard times for meals, and prevents children from working obscenely long shifts. “Establishment of a normal working day is the result of centuries of struggle between the capitalist and the worker” (382).

[edit] Chapter 11: The Rate and Mass of Surplus-Value

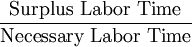

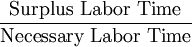

Having explained the rate of surplus-value earlier in Ch. 9, Marx focuses this chapter on the mass of surplus-value. The mass of surplus-value is completely dependent on the number of workers under the capitalist's control. We know that the rate of surplus value is equal to  or the

or the  or the

or the  . To increase this rate, the capitalist simply has to work his workers longer hours. This is simply a rate dependent on the degree of exploitation of the workers. The mass of surplus-value is determined by the rate of surplus value (S/V) multiplied by the number of workers. The more exploitation that exists, the more money the capitalist will possess.

. To increase this rate, the capitalist simply has to work his workers longer hours. This is simply a rate dependent on the degree of exploitation of the workers. The mass of surplus-value is determined by the rate of surplus value (S/V) multiplied by the number of workers. The more exploitation that exists, the more money the capitalist will possess.

This brief chapter is filled with typical Marxist theoretical situations to explain the mass of surplus-value but the core of the chapter lies in the three laws that Marx describes dealing with the rate of surplus-value. Marx explains as his first and most fundamental law that, "the mass of surplus-value produced is equal to the amount of the variable capital advanced multiplied by the rate of surplus-value".[21] Basically, as stated above, the mass of surplus-value is totally dependent on the total numbers of workers being exploited by the same capitalist and how much exploitation is going on. The formula  comes about, where s is equal to surplus value produced by the individual worker, v being equal to the variable capital advanced in the purchase of an individual labor power, V being the total amount of variable capital, P being the value of an average labor-power, and a' / a represents the degree of exploitation (surplus labor/necessary labor).[21] Marx lets it be known that under this law, that the mass of surplus-value is not constant in nature, but that a decrease in one factor can be made up by an increase in another factor, such as variable capital dropping but the exploitation of the labor-power increasing to make up for this change.

comes about, where s is equal to surplus value produced by the individual worker, v being equal to the variable capital advanced in the purchase of an individual labor power, V being the total amount of variable capital, P being the value of an average labor-power, and a' / a represents the degree of exploitation (surplus labor/necessary labor).[21] Marx lets it be known that under this law, that the mass of surplus-value is not constant in nature, but that a decrease in one factor can be made up by an increase in another factor, such as variable capital dropping but the exploitation of the labor-power increasing to make up for this change.

Marx's second law deals with the limitation of compensating for lacking factors. He says that the "compensation for a decrease in the number of workers employed cannot be overcome"[22] What we see is the natural tendency of capital automatically reducing the number of workers employed by the capitalist. It is important to note the average working day in terms of compensating for fluctuating factors, because it sets an absolute limit on such compensations. Marx's third law states that "The rate of surplus-value and the value of labor time, being given, it is self-evident that the greater the variable capital, the greater would be the mass of the value produced and of the surplus-value".[23] These two factors explained are completely dependent on the mass of labor performed by the worker, or better yet how heavily the worker is exploited. Marx states that this law, or the numerical value of the factors involved here, are determined by how much variable capital is advanced from the capitalist. He further suggests that we now know the capitalist divides his capital into two parts; one part on the means of production (a constant factor) and the other on the living labor-power, which is heavily exploited and forms his variable capital.

[edit] Part Four: The Production of Relative-Surplus Value

Chapters 12-15 focus on the ways in which capital seeks to increase worker productivity as a means of increasing the rate of workers' exploitation.

[edit] Chapter 12: The Concept of Relative Surplus-Value

In the beginning of this chapter, Marx provides an illustration of the working day whose length is defined, and its division between necessary labor and surplus labor is marked as well. The line, AC, looks like this:

A - - - - - - - - - - B - - C

The section AB represents necessary labor, and the section BC represents surplus labor. He then poses the question, “How can the production of surplus-value be increased, i.e. how can surplus labor be prolonged, without any prolongation, or independently of any prolongation, of the line AC?” [24]. Marx proposes that it is in the best interest of the capitalist to divide the working day like this:

A - - - - - - - - - B’ - B - - C

This is showing that the amount of surplus labor is increased, while the amount of necessary labor is decreased. Through this, part of the labor-time that was used by the worker for the worker is lost, and the lost time there would be used as labor-time for the benefit of the capitalist. When there is a change in the amount of necessary labor-time, and therefore an increase in surplus-value, Marx calls this relative surplus-value. (Whereas when there is an actual lengthening in the working day and surplus value is produced, this is called absolute surplus-value.) Marx then goes on to discuss what can decrease the value of labor-power. First, remember that the value of labor-power is “the labor-time necessary to produce labor-power” [25]. With this in mind, Marx says that the value of labor-power can be decreased if there is an increase in the productivity of labor. But productivity of labor cannot be increased without there first being a change in the mode of production, i.e. there must be innovations in both the technical and social conditions of the process of labor. And when the value of labor-power falls alongside an increase in the productivity of labor, commodities become cheaper. Along with this, Marx states that, as the productivity of labor increases, so, too, does the relative surplus-value; on the other hand, when there is a decrease in the productivity of labor, the relative surplus-value decreases as well. In other words, there is a direct proportion between the two things. The perpetual drive of capital according to Marx is to increase the productivity of labor, so that commodities can become cheaper. Through this process, the worker himself becomes cheaper. The reader is reminded that the capitalist is not interested in the absolute value of a commodity; instead, he is concerned with the surplus-value that is there in it, a value that is recognized through the sale of that commodity. Marx concludes that, through the increase of the productivity of labor, the aim of capitalist production “is the shortening of that part of the working day in which the worker must work for himself, and the lengthening, thereby, of the other part of the day, in which he is free to work for nothing for the capitalist” [26].

[edit] Chapter 13: Co-operation

A group working under a capitalist does as much work as another group of the same amount of people working under the same capitalist. Their skills and shortcomings balance each other out to make groups of the same number equatable. Upon dividing up groups into smaller subgroups, changes can be noticed. Marx states, "Of the six small masters, then, one would squeeze out more than the average rate of surplus-value, another less. The inequalities would cancel out for the society as a whole, but not for the individual masters." (p 441). To simplify, among individual groups, there will be stronger, more productive groups and weaker, less productive groups. However, when reexamining the subgroups as a whole, the strong balance out the weak and balance is restored. With this information Marx defines co-operation as, "When numerous workers work together side by side in accordance with a plan, whether in the same process, or in different but connected processes." (p 443). This works well for capitalists in that, social contact brings out a natural competitive nature in people which in turn produces more commodities. Co-operation also shortens the time needed to complete a certain task. Marx says, "If the labour process is complicated, then the sheer number of the co-operators permits the apportionment of various operations to different hands, and consequently their simultaneous performance. The time necessary for the completion of the whole work is thereby shortened." (p 445). The only problem for capitalists comes with payment. It is easier for a capitalist to hire fewer people and pay them for a longer period of time than to pay many workers for a short amount of time. In essence, the amount of capital a capitalist has to spare for payment affects how many laborers he can hire at any given time. With co-operation also comes resistance. The larger a group, the more likely they are to resist conditions implemented by the capitalist and so the more the capitalist must overcome their resistance. Marx also makes the point to say, "It is not because he is a leader of industry that a man is a capitalist; on the contrary, he is a leader of industry because he is a capitalist." (p 450). Marx concludes by showing an example of co-operation that many are familiar with: the creation of the pyramids. As the food grown in the Nile valley belonged to the king, he was able to commission a large number of people to work in co-operation with one another to create the pyramids in a very short amount of time.

[edit] Chapter 14: The Division of Labour and Manufacture

In section I, “The Dual Origin of Manufacture” Marx identifies two ways in which manufacture originates. The first method occurs when a series of workers with different trades are brought together to work for one capitalist under the same roof, in such a way that a single product passes from one worker to the next. Under this method tradesmen find themselves making only one type of product: “so that a locksmith working for a carriage company would make locks only for carriages when he used to make locks for a variety of different products ”.[27]. The second form occurs when a capitalist hires a number of workers, each worker making an entire product himself. Under the external circumstance of requiring a need to speed up production this method changes so that each worker is given a specific task within the making of a product”.[28]. Isolated jobs on each commodity can start to be assigned to one worker and a division of labour can be created in this manner. In section 2, “The Specialized Worker and His Tools” Marx argues that a worker who performs only one task throughout his life will perform his job at a faster and more productive rate, forcing Capital to favor the specialized worker to the traditional craftsmen”.[29]. In this section Marx also demonstrates that a specialized worker doing only one task can use a more specialized tool, which cannot do many jobs but can do the one job well, in a more efficient manner than a traditional craftsman using a multi-purpose tool on any specific task ”.[30]. Marx considers this a basic element of manufacture. In Section 3, “The Two Fundamental Forms of Manufacture- Heterogeneous and Organic” Marx argues that the production of various commodities produces a hierarchy of skilled and unskilled labor. Skilled labor requires large amounts of training or skill and tends to command a higher value of labor-power, while unskilled labor, which any man can do, takes little to no training and commands a lower value of labor-power”.[31]. Keeping these highly specialized workers focused on keeping there highly valued job skills along with keeping them divided from their trade as a whole making of one commodity further devalues there labor power to each of them. Also one item with several menial processes (each assigned to one worker) helps to divide the workers from the value of their own labor power. In section 4, “The Division of Labour in Manufacture and the Division of Labour in Society” Marx argues that the division of labor in society has existed long before capitalism. However, Marx sees the division of labour within a factory or workshop as something totally unique to the capitalist mode of production”.[32]. While physiological and social circumstances may mediate the division of labour in society, it is the need to produce surplus value which creates the need for a division of labour within manufacture. In section 5, “The Capitalist Character of Manufacture” Marx considers the way in which a division of labour within manufacture limits the mind and education of a worker. Marx also points to the revolution of machinery as a way to increase surplus-value by increasing the productivity of each worker thereby reducing the number of unskilled workers necessary.

[edit] Chapter 15: Machinery and Large-Scale Industry

[edit] 1. Development of Machinery

In this section, Marx explains the significance of machinery to capitalists and how it is applied to the work force. The goal of introducing machinery into the work force is to increase productivity and not to decrease the toil of the worker. When productivity is increased, the commodity being produced is cheapened. Relative surplus value is amplified because machinery shortens the part of the day that the worker works for his or her means of subsistence and increases the time that the worker produces for the capitalist. As discussed in previous chapters, when the time it takes for the worker to achieve there means of subsistence decreases, the more time they will spend working for the capitalist.

At this point, Marx discusses the difference between tools and machines and their application to the process of production. Marx claims that many experts, whether they are trained in mathematics, economics or experts in mechanics see no difference between tools and machines. He claims that they “ call a tool a simple machine and a machine a complex tool” (Marx 492). Marx continues to elaborate on this definition problem, explaining that some people distinguish between a tool and a machine “ by saying that in the case of the tool, man is the motive power, whereas the power behind the machine is a natural force independent of man, for instance an animal, water, wind and so on” (Marx 493). The flaw with this approach, when defining tool from machine, is illustrated when Marx points out that this argument would indicate that a plow, which is powered by an animal, would be considered to be a machine and Claussen’s circular loom, which is able to weave at a tremendous speed, is in fact powered by one worker and there fore considered to be a tool. Marx defines the machine on page 495 of capital volume I when he says “ The machine, therefore, is a mechanism that, after being set in motion, performs with its tools the same operation as the worker formerly did with similar tools. Whether the motive power is derived from man, or in turn from a machine, makes no difference here.”

There are three parts to fully developed machinery:

-

- 1. The motor mechanism powers the mechanism. Be it a steam engine, water wheel or a person’s caloric engine.

- 2. The transmitting mechanism, wheels, screws, and ramps and pulleys. These are the moving parts of the machine.

- 3. The working machine uses itself to sculpt whatever it was built to do.

Marx believes the working machine is the most important part of developed machinery. The working machine is what began the industrial revolution of the eighteenth century and continues to turn craft into an industry.

The Machine is able to replace a worker, who works at one specific job with one tool, with a mechanism that accomplishes the same task, but with many similar tools and at a much faster rate. One machine doing one specific task soon turns into a fleet of co-operating machines accomplishing the entire process of production. This aspect of automation enables the capitalist to replace large numbers of human workers with machines. It also enables capitalist to choose their human workforce to a much larger pool of available workers. The worker no longer need be skilled in a particular trade because their job has been reduced to oversight and maintenance of their mechanical successors.