Plan your journey with one of the flexible car rentals

It is business trip, or vacation trip or family trip or festival

trip chose this car hires http://www.locature.fr/, as it is proving to

show best effects of it in serving the people for long journey, short

journey, 3 days journey, weekend journey, one way or two ways. I came to

know about this car rentals locature

through internet, as once I was searching about travel information and

thought would use this car hire when I travel. This was the right time

to choose this car hire I felt. My journey was to France and had to

visit Cannes city, that was best known for its beaches and also know for

film festivals as the Hollywood stars visit there. I also got the

chance to visit this Film festival for which I visited Cannes city. The

day of journey came and I started off with the flight and reached the

airport and found the car hires waiting for me in advance. He took me to

the hotel places and as next day the festival ceremony was going on the

car came on time and I reached the place on time. Here I could enjoy

festival by sitting with some of the important people and watching them

live. I saw many Hollywood stars from front which was my all time dream

and that came true now and took the autograph of the celebrity people.

Next day I visited beaches, resorts place, rivers, mountains, and some

tourist spots that really amazed me a lot and inspired me.

This was the first time I visited any foreign country and my trip was successful with the help of the car rentals who made it possible by making me visit some of the wonderful places in the city and especially the Cannes film festival.

You people are simple superb and I wish you do great job in future and get great success.

This was the first time I visited any foreign country and my trip was successful with the help of the car rentals who made it possible by making me visit some of the wonderful places in the city and especially the Cannes film festival.

You people are simple superb and I wish you do great job in future and get great success.

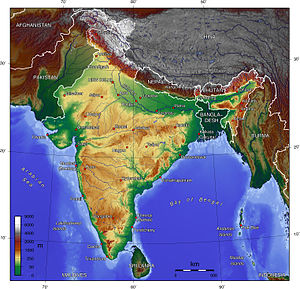

Looking at Tourism in India

July 28, 2011 By Leave

a Comment

Image by sonjalind

via Flickr

The impact of tourism on India’s national gross domestic product is estimated at US$275.5 billion by 2018. In fact, the World Travel and Tourism Council declares India as a travel hotspot from now until 2018. People are not only drawn to India for cultural history, but they also travel for business, medical purposes, and sports such as the 2010 Commonwealth Games.

Medical tourism is on the rise in India. Travellers can receive high-quality treatments at a fraction of the prices they expect. Surgery costs average thirty percent lower than other well-known medical tourism destinations such as Thailand. Procedures people come to undergo include bone marrow transplants, cardiac surgery, orthopedic surgeries and liver transplants. India is best known for heart surgery. Access to leading medical technology at alluring rates is not the only place tourists spend their money on. Many people come seeking a taste of the unique culture and history India possesses.

India’s 5,000 year old history promises to deliver an unmatched travel experience to tourists. The Taj Mahal is one of the most familiar sights of India. Millions of travellers visit the historical site each year. Other sites that draw people in include the Mahabodi Temple, skiing in Shimla, and the stunning Lotus Temple in Dehli.

India’s Place in the Agricultural Landscape of the World

July 15, 2011 By Leave

a Comment

Image via Wikipedia

With a population of 1,189,172, 186 and counting, one of the biggest challenges for the Indian agricultural industry is the population grows faster than farm production. The CIA World Fact Book lists India as the second most populated country in the world. Food items such as rice and wheat rise demand to keep up with the population boom. For many years, India has been an autarky, or self-sufficient economy. But since the 1990, it continues to develop an open-market policy. Agricultural output for India ranks second among the world economies.

Agricultural policy is focused on improving self efficiency of food production to combat hunger issues. India is among the world’s highest producers of rice, cow milk, sugar cane, buffalo milk and wheat. The Sugarcane Breeding Institute of Coimbatore, India was established in 1912 to improve sugarcane production. It is one of the oldest crop research institutes worldwide. Indian stock of the sweet crop is used in 26 other countries across the globe.

The institution is now conducting a research project to help the about 35 million farmers who cultivate and rely on the crop. The project is focused on creating a website where information can be shared easily. It’s main goals are to aid farmers and support sugarcane reasearch.

Investing in India Worth Looking At

July 5, 2011 By Leave

a Comment

Image via Wikipedia

In March of this year, investment icon Warren Buffett stated he was looking to invest in economic powerhouses like India. Asian Development Bank reports that the equity market in India ranks third in the world. With about US$600 billion in market capitalization, it sits right behind China and Japan as one of the major equity markets in the Asian region. India is expected to boost economic growth by at least nine percent annually within the next ten years. India’s economy offers investors a variety of opportunities. India’s service sector forms fifty percent of its economy. Other industries include pharmaceuticals, energy and consumer goods.

Domestic industry is on the rise in India. Last July, New Delhi opened a 3 billion dollar addition to the Indira Gandhi International Airport. Terminal 3 (T3) took 37 months to complete. Prime Minister Manmohan Singh, who dedicated the new terminal, stated its creation was a global benchmark for India. India’s government has worked to strengthen its country’s infrastructure.

The Bombay Stock Exchange is the fourth largest stock exchange in Asia. It’s also the second oldest in the world, with a history dating back to the 1850′s. With a youthful demographic and a solid work ethic, the global economy will see more from India in years to come.

Industries and Investment in the Economy in India

June 8, 2011 By Leave

a Comment

Image via Wikipedia

More than 10% of those employed work in industrial fields, and these include manufacturing and production of textiles. This industry was part of the reform, which was altered by reducing costs of the factories in order to sell the materials at a lower cost and stay competitive with the materials produced in China and other nearby countries. Another sector of business in which India’s economy has grown drastically over the years is process outsourcing for large companies which are often located in the United States. Since many residents of India are fluent in English, they are able to telecommute and answer calls for customer service, tech support, and other similar service industries. In fact, seven of the large firms located in India make up almost half of the top fifteen outsourcing companies across the globe. India also produces a good amount of agriculture, including logging, fishing, and forestry. Investment is increasing as banks become more stable and secure, which was also part of the economic reform.

India’s growth rate is approximately 7% on average, and has greatly reduced the amount of poverty among its residents over the years. The main industries continue to grow, which has given more individuals the opportunity to have stable employment and provide for their families.

Issues and Trends in the Indian Economy

June 6, 2011 By Leave

a Comment

Image by World

Economic Forum via Flickr

It isn’t too big of a surprise that importing/exporting and automobile sales have been on the decline, since the economy worldwide is struggling and many individuals are choosing to buy locally to support their economies. Inflation in India has increased more rapidly than it has in years past, making it more difficult for families to be able to afford groceries, clothing, and other necessities. The Prime Minister of India is trying to take matters into his own hands, especially after suffering backlash from scandal, corruption among the government agencies, and contentment with the current situation. Many residents of India are frustrated with their government, who seems unwilling to make the necessary reforms in an attempt to boost the economy. Such reforms have been seen in the United States, such as tax credits for homebuyers and those who were employed for the whole year, and helped increase the amount of money received on many tax returns. However, without sufficient funds to pay for such programs, it can be difficult to upswing an economy that is spiraling downward.

There is hope that the Indian economy is simply encountering a speed bump in its growth. Some predict that it will turn around, but only time can show what the future holds for those living and working in India.

Current Affairs – India

June 2, 2011 By Leave

a Comment

Image via Wikipedia

It is interesting to note the stark differences among those residing in India; in 2010, it was estimated that the economy grew more than 8%, but the investment rate dropped by over 30%. The restrictions on business make it very difficult to start a company; certain cities require as many as 37 licenses obtained over seven months in order to open a warehouse. Even once it has been properly built, it can be difficult for trucks and workers to get to the doors due to rough and crowded roads, limited water, and power outages. While on the other hand, businesspeople are hopeful that it will rise to be one of the strongest economies within the next twenty years. Before this can happen, however, India will need to find some level ground among its residents. This may require assistance from the government, but the political scene has been writhe with scandal and corruption.

Once India is able to strengthen its monetary system, those who are returning to the country and investing in local businesses can help increase the stability of the economy. This might mean a very promising future for those residing in the beautiful country.

Land Value at a Great Place

May 22, 2011 By Leave

a Comment

http://www.flickr.com/photos/o5com/

Land Value at a Great Place

Thanks to a difficult economy there are many changes made regarding the value of the properties across the world. This includes properties fully built and land value. While a short time ago the value of property dropped extremely low making it difficult for sellers to get what they had invested in property, the value has started a steady increase. Purchasing land today is a great way to invest money since it is not at the same rate it was recently but appears to be on the rise. This means buyers will be increasing their property value after purchase fairly quickly. Clearly this changes based on the location of the property and the marketability of it in general.

Finding the right property for your situation can be a challenge given the many obstacles you might find regarding financing today. This having been said, there are some great options available all over the world that will easily have you purchasing your next property in no time at all at a rate that is well within your range. With some basic guidelines, understanding what you are looking for and knowing what your limitations are you can easily find property that at will easily increase in value. It is a great time to invest in new property regardless of your future goals for the property. There are great properties to be had with a little research and planning ahead. Having a plan before you get started is the key to a successful hunt for the right property with the right land value for your needs. You want to be sure the property increases in value as fast as possible.

New Auto Plant in India

May 15, 2011 By Leave

a Comment

http://www.flickr.com/photos/joel-h/

New Auto Plant in India

In an effort to increase the competition between BMW, Daimler and Audi, Jaquar Land Rover opened their first plant today in India. This plant is opened in Pune and will start to build Freelander 2 sport utility vehicles from the ground up from kits shipped to them from the Liverpool plant. This is great news for both India and for Jaquar Land Rover as it will open up new business in both. The company will be afforded the ability to put together more vehicles, quickly and at a decent price keeping the prices of the vehicles affordable in comparison to the competitors.

This will also bring great employment opportunity to the area of Pune and will give them a boost economically that they are much in need of. Taking this step is great for all involved on several levels and offers the company the chance to keep on producing the quality vehicles they have always built. These steps for the community will produce additional employment and will also cause an increase in other economic areas within the community. The future for the company and the area look bright with the prospect of turning out large numbers of vehicles. Barring an unexpected issues they are well on their way to creating a great income with the help of India. The next year will bring signs of the success or demise of this plan for the auto manufacturer and the area. Through great efforts they will do the best to create a new advantage to the competitors.

Protecting Yourself Financially

May 2, 2011 By Leave

a Comment

http://www.flickr.com/photos/jollyuk/

Current economics are tough all around. It is vital that those in a difficult economy use the opportunity to reassess how they are spending their money. This is both true in business and personally. There are a few basics that work for nearly anyone in assessing the current status of your finances and deciding where you can cut back on spending to make a difference for your future. You can easily find the flaws in your current budget if you just do a bit of review of the current situation. Taking time to understand that the economics are difficult all over the world will help you to make the tough decisions to reduce the spending.

Reducing the spending is something that needs to be done in order to stay in line with the current trends of the economy. This means that you need to really think about what you need to be spending money on and what you can easily do without. If you are spending too much money on entertainment or eating out you may want to reassess your line of thinking. Take money to pay your savings account first and foremost to ensure that you are not stuck in a terrible situation. You might be surprised to find how much money you are spending on things you simply do not need in your life. It is important to protect yourself in the event of financial difficulty. Taking steps to plan ahead for the worse could be what saves you in the long run.